In a significant ruling, the Delhi High Court has held that services rendered by advocates are professional activities, and, therefore, they cannot be levied with taxes under the “commercial establishment” category [South Delhi Municipal Corporation v. BN Magon].

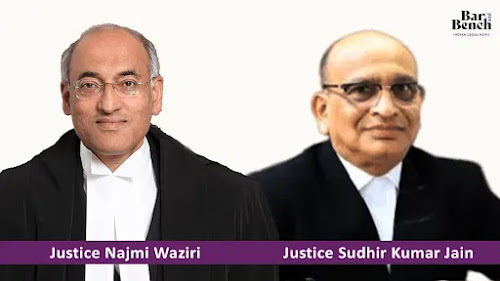

A Bench of Justices Najmi Waziri and Sudhir Kumar Jain was hearing an appeal against the decision of single-judge holding the same in January 2015.

After reading the taxation statute, the Bench underlined that services of advocates did not amount to “commercial activity” and they cannot be subjected to such tax.

“The rule of strict interpretation of taxation statute has to be applied. There is no scope of reading any derivative meaning or of reading any intent of the statute. Insofar as the statute has not included ‘professional activity’ of lawyers as ‘commercial activity’ the former cannot be put to tax,” the order, made available recently, stated.

Seeing no reason to interfere with the single-judge’s verdict, the Bench termed the appeal as being "without merit” and dismissed it.

The issue arose after the Municipal Corporation of Delhi (MCD) in 2013 issued two orders after assessing the property tax on a lawyer for running a “commercial activity” in his Greater Kailash 2 premises. The lawyer challenged the assessment orders, which were eventually quashed by the order of the single-judge of the High Court.

Before the Division Bench, the MCD submitted that it had powers to levy property tax on all lands and buildings under its jurisdiction. Therefore, unless consciously excluded, there cannot be any building, property or activity that cannot be subjected to tax, it argued.

Some of its contentions were:

A building or a part of it used for transaction of business or for keeping of books, accounts and records shall be considered as a “business building” and therefore subject to levy of property tax.

A lawyer’s services fall within the category of professional activity and, that part of the building used for a professional activity would fall within the definition of a “business building” as per a clause the 2004 bye-laws.

The clause categorically includes office buildings premises solely or principally used as office or for office purposes.

The ambit of a “business building” was wide as well as inclusive under the Delhi Municipal Corporation Act, 1957.

Activities carried out by advocates/professionals are commercial and non-domestic in nature, and, therefore, subject to tax and simply because such activity is carried out from residential premises, as per permitted use under MPD 2021, the activity would not become residential.

The respondent refuted all of the MCD’s contentions, submitting that the single-judge had dealt with each of them in his judgment.

In the Court's opinion, MCD’s contentions were ex facie untenable as there was no such “deeming provision” in law for taxation.

“Taxation powers have to be specifically mentioned and categories of taxable activity have to be defined,” it remarked.

The Court noted that the Master Plan of Delhi (MPD), 2021 permitted professional activity in residential buildings, subject to certain conditions.

“However, what is to be noted is that the said provision of MPD, does not empower the (municipal) corporation to levy tax for professional activity being carried out from residential buildings,” it added.

Referring to the Supreme Court decision in State of West Bengal v. Kesoram Industries Ltd and others, the Bench noted that under the Delhi Municipal Corporation (DMC) Act, there was no power to tax “professional activities” carried out from residential buildings.

Interestingly, the clause of the bye-laws referred only to a “professional establishment” but did not define either “professional” or “establishment”.

“Rate of taxation is another issue but for taxation to extend to a class of activity, such activity must be specified, defined and included in that class/category. Neither the Act nor the bye-laws define 'professional activity' carried out by advocates, architects and doctors, etc,” the Court underlined.

Standing counsel Sanjeev Sabharwal and Advocate Shweta appeared for the MCD.

Advocate BN Magon appeared in person along with Advocate Neeraj Gulati.